What is a stock split? This refers to a company dividing shares in a specific ratio. This is done to reduce the price of a single share. Many big corporations do this because it creates low cost shares that investors can buy, especially when their shares skyrocket to higher prices. But when is Google stock split?

Google shares are one of the most sought-after shares in 2023 and will still be for decades to come. Due to its inventions regarding AI and advancements in digital marketing, new buyers wait for stock splits eagerly. Therefore, if you are an investor wanting to invest in Google stocks, read this post till the end.

What Is A Stock Split?

Companies split their stock to produce new shares by dividing their current shares by a predetermined ratio. The split thus decreases the prices of each share while keeping the market capitalization of a firm (and values of investors’ holdings) constant.

For example, Stock A is valued at $2,000. Each share would become ten shares, each worth $200, if the corporation opted to split its stock 10-for-1.

In principle, stock splits increase the number of shares outstanding while maintaining the company’s value. In fact, after the announcement of the split, stock splits might momentarily boost market volatility.

When Is Google Stock Split 2022?

As of now, you should not ask when is Google stock split. Instead, you should ask when was Google stock split.

The Board of Directors of Alphabet approved the bill for a 20-for-1 stock split on February 1, 2022. This was in the form of a one-time special equity dividend on each share of the Company’s Class A, Class B, and Class C shares. To raise total authorized Class A, B, and C share stocks to facilitate the Stock Split, shareholder consent is required.

If permission is granted, a dividend of 19 extra shares from the same class of stock will be given to each shareholder of the company following its closing of business on July 15, 2022. The last Google stock split date was on 15th July 2022.

Should You Purchase Google Stocks Before Or After The Split?

Depending on when is google stock going to split, expert opinions are mixed. Both perspectives regarding the best time to buy Google Stocks have been gathered here.

1. Purchase Google Stock Before The Split

One of the key justifications for doing so is the likelihood that investors will drive up the share price before the split. According to past trends, stock prices often increase in the days and weeks preceding a split. The price of Alphabet has increased by more than 8% during the past five days. Stock splits frequently spark investor interest, which elevates the share price.

2. Purchase Google Stocks After The Split

People who couldn’t purchase Alphabet shares at their current price of $2,300 will likely acquire them at the new, cheaper price following the split. The stock will be considerably more accessible to folks with modest resources when the price is closer to $115. Future profits and company prospects are unaffected by the stock split.

Is Investing In Google Stocks A Good Option?

You can still think about purchasing Google stocks even if you haven’t brought the shares. In the upcoming years, there are still triggers that might raise the price of Alphabet’s stock. Google continues to have a global market share of 92%. Therefore, there is no disputing its supremacy in the search industry. Additionally, it has 28% of the global market for digital advertising.

Even after experiencing a large correction during the most recent bear market, Alphabet investors have had returns worth 4170%. This has been recorded since its IPO in 2004. According to the majority of analysts, Alphabet has lengthy development potential. Instead of the futility of a stock split, investors should concentrate on the company’s superior execution, market leadership, and long-term potential.

Current Google Stock Prices

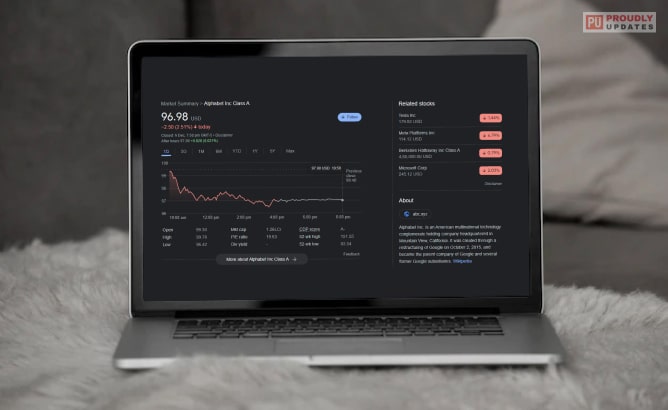

The market value of Google is currently close to $1.83 trillion. It’s anticipated that it will reach $2 trillion soon. The return on Google stock over the past 12 months has been roughly 33%, while its returns have been negative by about 4%.

The current Google stock price (as of publishing this post) after learning when is the google stock split happening has changed. It’s currently $100.6 per share.

Should You Buy Google Stock Before Or After A Split?

If you are thinking about whether you should buy Google stock after or before a split, then there is no definite answer to this question.

To elaborate on this topic you need to understand that when a company increases its shares or splits their stocks to create more stocks it does not impact the company in any way.

Especially the fundamentals of that company which remains unaffected by the stock split. So the stock split event of the company remains neutral without any significant effect on the valuation of the company. The company’s financial performance also remains the same with the stock split.

So you should not put much importance on when to buy a Google stock based on stock split timings. In fact even when selling your stock you should not factor in the stock split event of any company.

Instead, your main factor when deciding to buy Google stock or any other company’s stock should be more focused on your research about the company’s financial situation. You must analyze the particular financial situation of the company you want to purchase stock from and see its potential growth.

If a company’s financial situation has been growing for a long duration of time without any major disruption the company shows greater chances of doing well as time passes. Whether you are buying or selling in this case Google stock you might want to analyze Google’s financial aspect that any other factor. Since the last two decades Google has grown exponentially so you can decide if you would like to buy its stock or not based on this financial calculation.

Stock Split Benefits Investors Of The Company

On the other hand the stock split of a company often leads to an increase in liquidation of a company’s stock that benefits investors of the company. You might be thinking how can this be possible shouldn’t the company benefit more from the stock of the company.

But that is not the case as investors of the company who previously bought stocks of the company get to sell their stocks at higher price after splitting the stocks. So if you purchased a stock from Google you become an investor of the company. When stocks are slitted you get to sell two stocks instead of one which will give you more money. In fact if an investor does not want to sell stock but instead more stock after stock split that increases his investment in the company which will give him more return in future.

FAQs (Frequently Asked Questions):-

Investors have asked various questions regarding when is google stock split. My answers to their questions are:

Ans: The shares of the A class are denoted by GOOGL and have one vote, whereas the shares of the C class are denoted by the symbol GOOG and have no rights to vote. Other than voting rights, there is really no incentive to choose one share over the other because they both have similar economic stakes in Google’s company.

Ans: Various investment gurus gave the company a “buy” rating as of December, 2022. In the same vein, most investment experts gave GOOGL a “buy,” or “strong buy,” while only a few gave a “hold” rating. Your trading goals will determine if Google is the best stock for you. It’s crucial to conduct your own research.

Ans: Many investor experts forecast that the price of Google stocks is expected to rise every year. It’s forecasted that Google stock prices will increase to $119 in 2023. Then, it will increase to $136 in 2024, $150 in 2025, and finally, $192 by 2030.

So Do You Want To Buy Google Stocks After The Split?

So when is Google stock split?

The last Google stock split took place on 15th July 2022. After the split of stocks, lots of investors bought shares of Alphabet, its parent company. However, they have not announced when the next stock split is going to take place or if it will ever take place in the future.

Read Also: